Income contingent repayment calculator

If you have multiple student. The Income Contingent Repayment ICR plan is designed to make repaying education loans easier for students who intend to pursue jobs with lower salaries such as careers in public.

Income Driven Repayment Calculator Fitbux Articles

Here are the crucial facts about Income-Based Repayment.

. You can estimate your payments with various interest rates and loan terms using this calculator. ICR at a glance. Our calculator model includes all of the most common IBR details including.

20 of your discretionary income or fixed payments based on a 12-year loan term whichever is lower. Using the same numbers from the example above. Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment.

529 Plans 529 Plan Ratings and Rankings. You can estimate your payments under various repayment plans using this. How an ICR Plan Works.

This calculator determines the monthly payment and estimates the total payments under the income-contingent repayment plan ICR. This student loan income contingent repayment calculator is easy to use. Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment.

Updated 2022 federal poverty data used to calculate your monthly discretionary income. Income-Contingent Repayment ICR Calculator. The Income Contingent Repayment ICR plan is designed to make repaying education loans easier for students who intend to pursue jobs with lower salaries such as careers in public.

An income-contingent repayment calculator can be used to determine personalized estimates of the monthly payments and total payments under ICR. Federal student loan borrowers pay a percentage of their discretionary income 10 15 or 20 depending on the specific income-driven repayment plan you choose. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt.

Of Health and Human Services poverty. Income-contingent repayment can reduce your federal student loan payments allowing you to pay 20 of your discretionary income each month or. Heres how it works.

Under Income Contingent Repayment the monthly payment is 0 for borrowers with family incomes that are less than or equal to the US. Federal Student Aid. Find Your Path To Student Loan Freedom.

How to calculate income-contingent repayment monthly payments. IBR sets your loan payments at 15 of what the government considers your discretionary income if your loans were taken out. Using the same numbers from the example above.

For many borrowers the monthly payment amount under the ICR Plan will be 20 percent of their. Enter your student loan balance and average interest rate. The Income-Contingent Repayment plan is an income-driven repayment option for federal student loans.

Income Driven Repayment Calculator Fitbux Articles

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

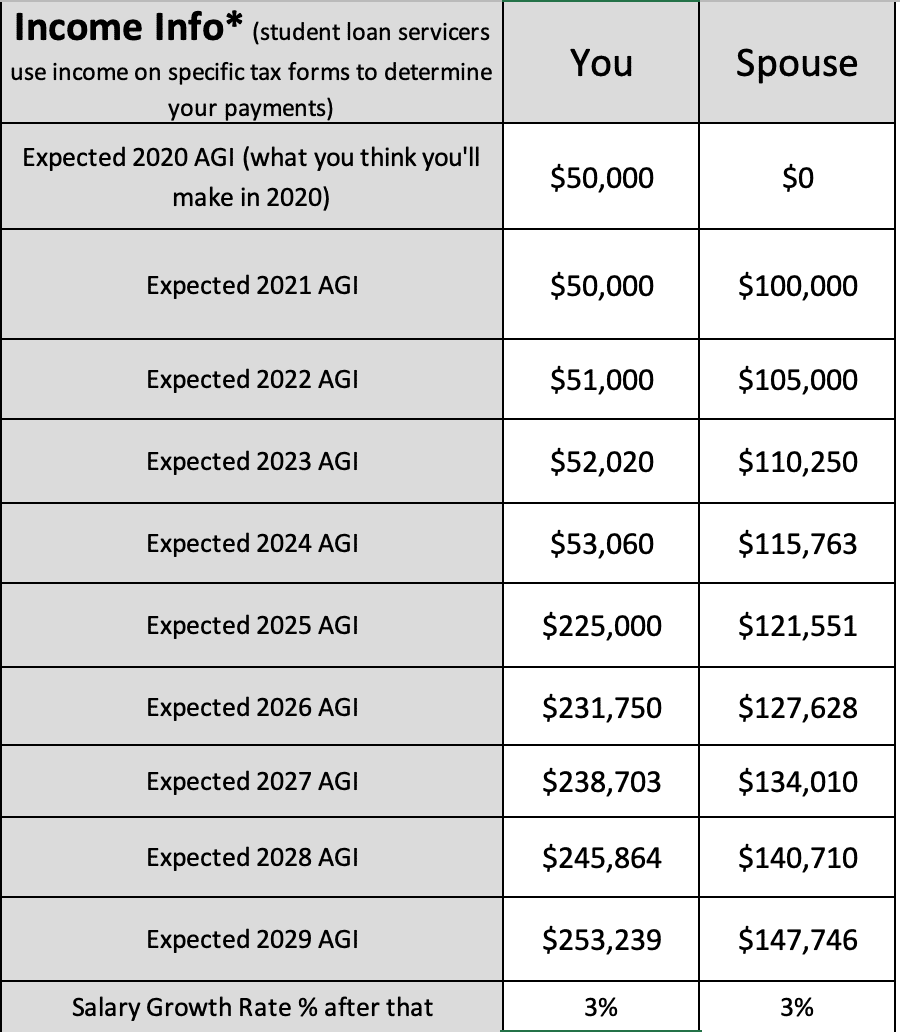

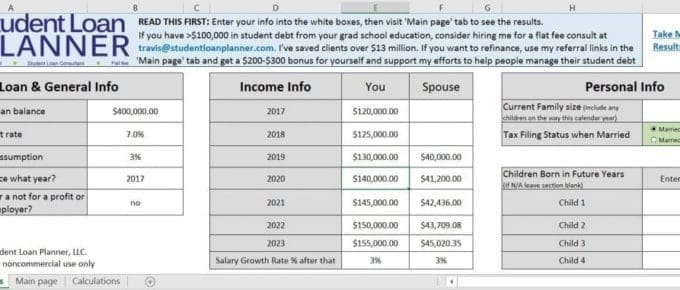

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Top 6 Best Student Loan Calculators 2017 Ranking Education School Loan Calculators Advisoryhq

2

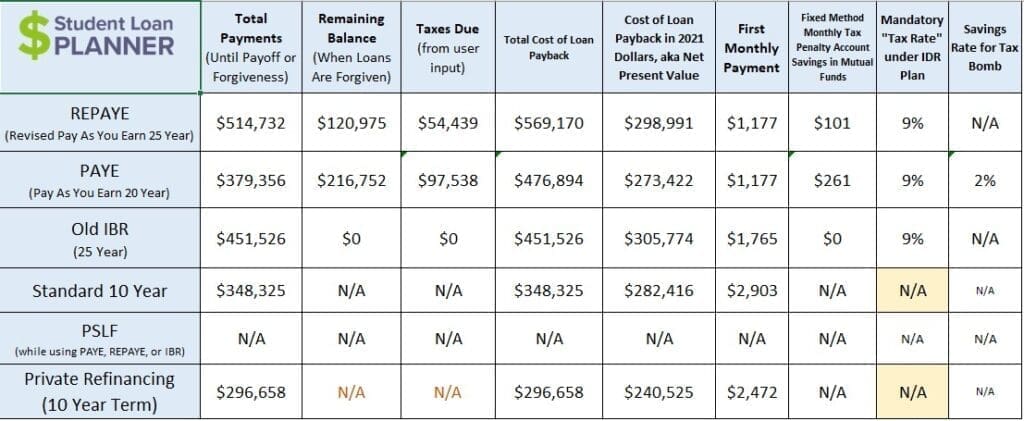

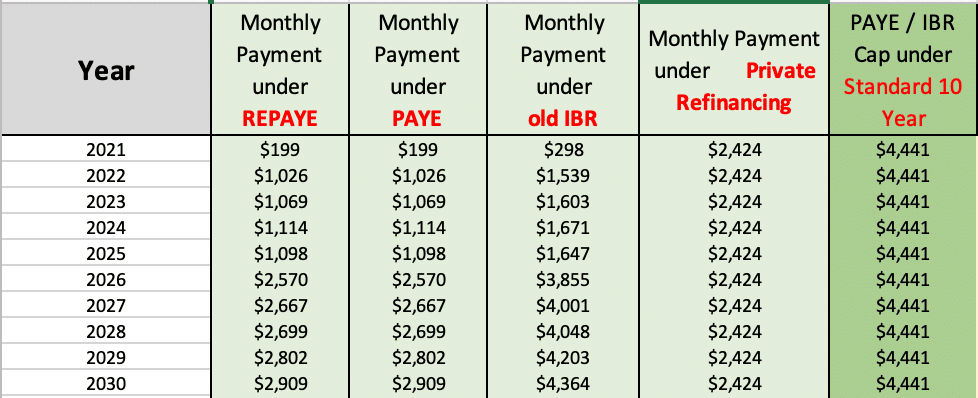

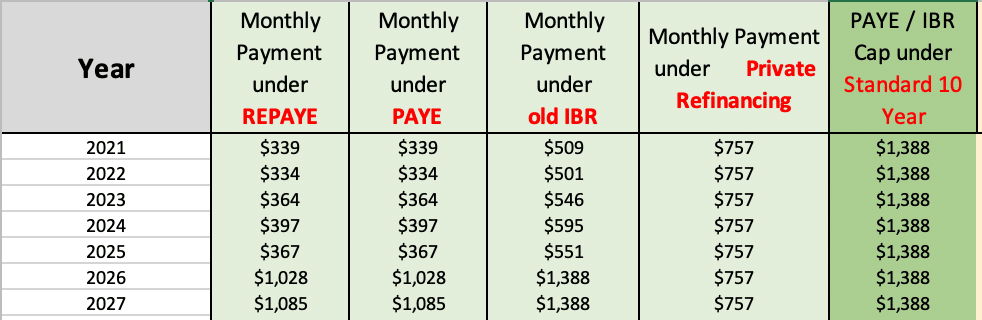

Paye Vs Repaye Vs Ibr How Do They Compare Student Loan Planner

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

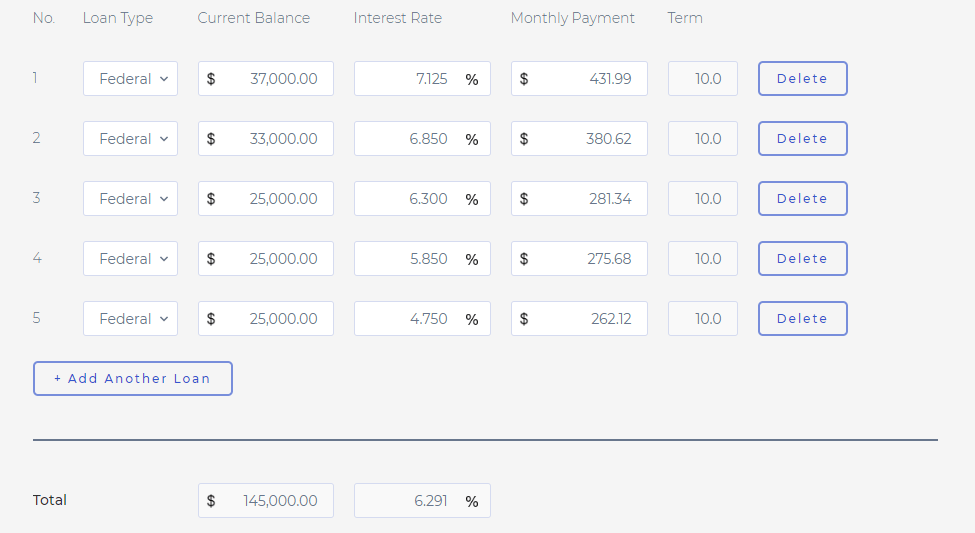

How To Pay Off 150 000 In Student Loans

Income Based Repayment Calculator Includes Biden Ibr Plan

Student Loan Forgiveness Calculator With New Biden Idr Plan 2022

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

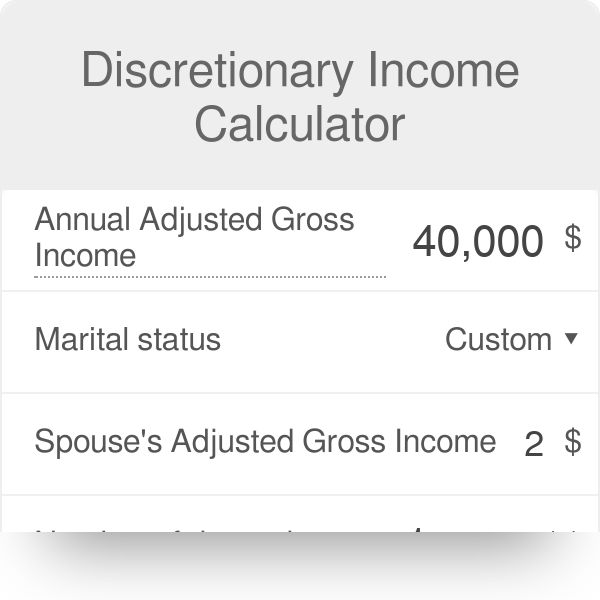

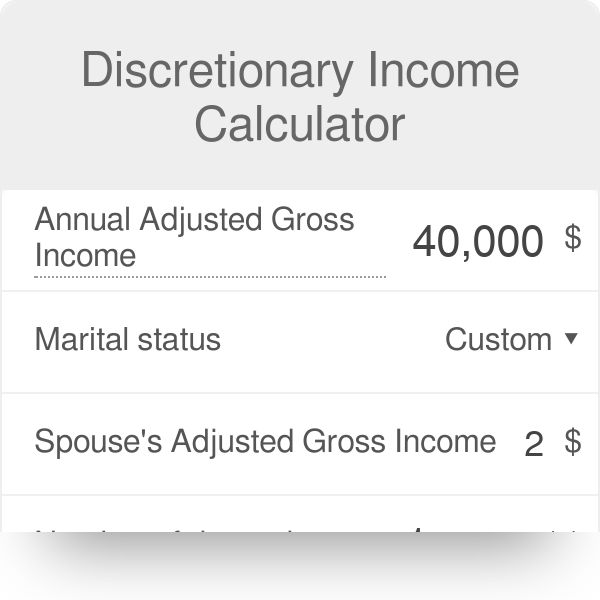

Discretionary Income Calculator

Defining And Calculating Discretionary Income For Student Loans

What Is Income Contingent Repayment

Pin On Information